Stamp duty is a mandatory tax paid on property transactions, and in Tamil Nadu, the process has been streamlined through the TNREGINET Portal (https://tnreginet.gov.in/). This portal, launched by the Registration Department of Tamil Nadu, enables citizens to calculate, register, and pay stamp duty online conveniently.

Whether you’re purchasing a property, registering a lease, or completing any legal documentation requiring stamp duty, understanding how the TNREGINET portal works is crucial.

TNREGINET Stamp Duty Registration Fees

Stamp duty fees in Tamil Nadu depend on the nature of the transaction and the type of document being registered. Here’s a breakdown of the most common registration fees:

| Document Type | Stamp Duty | Registration Fee |

| Sale Deed (Property) | 7% of Market Value | 4% of Market Value |

| Gift Deed (Family Members) | 1% of Market Value | 1% of Market Value |

| Exchange Deed | 7% of Market Value | 4% of Market Value |

| Lease Agreement (<30 yrs) | 1% of Total Rent | 1% of Total Rent |

| Mortgage with Possession | 4% of Loan Amount | 1% of Loan Amount |

| Mortgage without Possession | 1% of Loan Amount | 0.5% of Loan Amount |

| Partnership Deed | Rs. 300 | Rs. 300 |

| Power of Attorney (Family) | Rs. 100 | Rs. 100 |

Note: These rates may vary based on location (urban or rural), type of property, and nature of transaction.

How to Calculate Stamp Duty on TNREGINET?

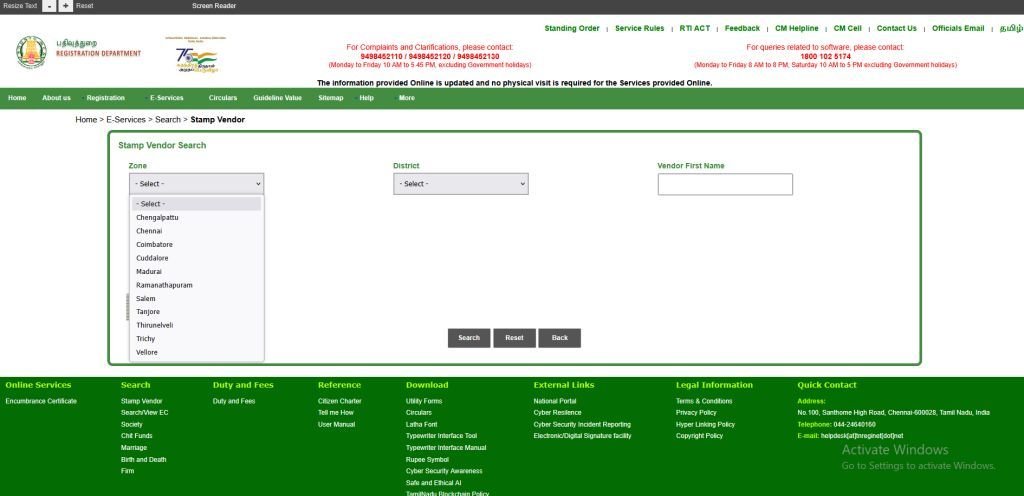

To make the process easier for citizens, TNREGINET provides an online calculator to determine the exact stamp duty and registration fees applicable to your transaction. Here’s how you can calculate stamp duty:

Steps to Calculate Stamp Duty:

- Visit the TNREGINET Portal: Go to https://tnreginet.gov.in

- Select “Calculators” under the “More” section from the top menu.

- Choose the appropriate calculator:

- Guideline Value

- Stamp Duty and Registration Fee Calculator

- Enter the required details such as:

- Property type

- Guideline value

- Document type (Sale/Gift/Lease/etc.)

- Property location (District, Village, SRO)

- Click on “Calculate”

The system will auto-generate the stamp duty and registration fee amount based on your inputs.

Stamp Duty Rates in Tamil Nadu

Stamp duty rates in Tamil Nadu are governed by the Indian Stamp Act, 1899 and Tamil Nadu Stamp Rules. Here are the prevailing rates for common transactions:

Property Related Stamp Duty:

- Sale Deed: 7% of market value

- Gift Deed (to family): 1%

- Gift Deed (to others): 7%

- Lease Deed (for less than 30 years): 1%

- Lease Deed (for more than 30 years): 2%

- Partition Deed (among family): 1% on separated share

- Mortgage with possession: 4%

- Mortgage without possession: 1%

Non-Property Transactions:

- Power of Attorney (POA): Rs. 100 to Rs. 1000 based on type

- Affidavit/Declaration: Rs. 20

- Partnership Deed: Rs. 300

These rates are applicable throughout Tamil Nadu, including Chennai, Coimbatore, Madurai, and other districts.

How to Pay Stamp Duty by tnreginet.gov.in

You can pay stamp duty and registration charges online via the TNREGINET portal using the following steps:

Steps to Pay Stamp Duty Online:

- Register/Login on TNREGINET Portal:

- Visit https://tnreginet.gov.in

- Click on “User Registration”

- Log in using your credentials (User ID & Password)

- Create an Application:

- Navigate to “Create Application” under the “Create Document” menu

- Select the type of document

- Fill in buyer/seller details, property details, and document type

- Stamp Duty & Fee Calculation:

- The system will auto-calculate the applicable charges

- You can verify the breakdown before proceeding

- Choose Payment Option:

- Online payment via Net Banking, Credit/Debit Card, or UPI

- Download the e-Challan or acknowledgment slip

- Schedule an Appointment:

- Book a slot at your nearest Sub-Registrar Office (SRO)

- Visit the office with printed documents and payment receipt

- Verification and Completion:

- The registrar will verify documents and finalize the registration

- You will receive the Registered Deed copy either online or at the office

Frequently Asked Questions (FAQs)

Can I pay stamp duty for a property in Chennai through TNREGINET?

Yes, TNREGINET allows stamp duty payment and document registration for all locations across Tamil Nadu including Chennai, Madurai, and Coimbatore.

Is it mandatory to pay stamp duty before document registration?

Yes, stamp duty and registration fees must be paid in advance to complete the legal registration of any document.

Can I edit my application on TNREGINET after submitting it?

You can edit your application only before final submission. Once submitted and payment is made, no changes can be made.