The TNREGINET Guideline Value is a crucial component in property transactions across Tamil Nadu. Managed by the Tamil Nadu Registration Department, this value acts as a benchmark for determining stamp duty and registration charges during property registration. Whether you’re buying land, selling a flat, or transferring ownership, understanding the guideline value in Tamil Nadu can help you make informed decisions and stay compliant with legal requirements.

What is Guideline Value?

Guideline Value (GV) is the minimum value fixed by the state government for a property in a specific location. It helps determine the market value of land or property for taxation and legal purposes. The TNREGINET Portal offers easy access to the latest guideline values for plots, flats, and buildings.

| Portal | TNREGINET portal |

| State | Tamil Nadu |

| Department | Registration Department, Tamil Nadu |

| Services | Guide value, stamp duty calculation, building value calculation, certificate of inheritance, marriage registration, birth and death certificate |

| Eligibility | Citizens of Tamil Nadu |

| Website | https://tnreginet.gov.in/portal/ |

How to Check Tamil Nadu Land Guideline Value?

You can easily check the TN guideline value online by using the TNREGINET website. Just follow these steps:

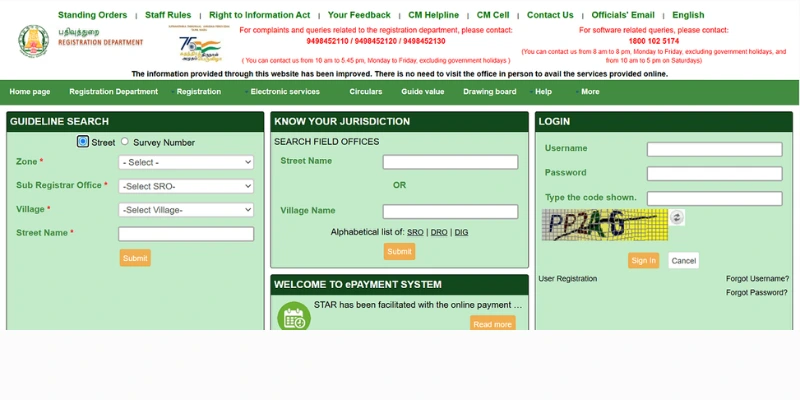

Step 1: Go to the official TNREGINET website.

Step 2: On the homepage, click on the ‘Guide Value’ option.

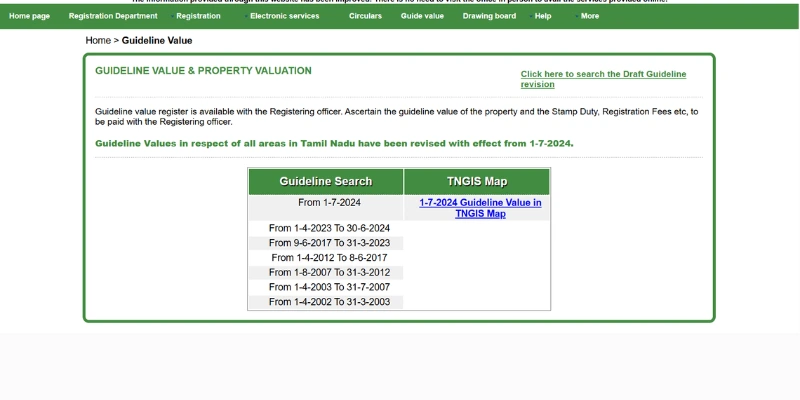

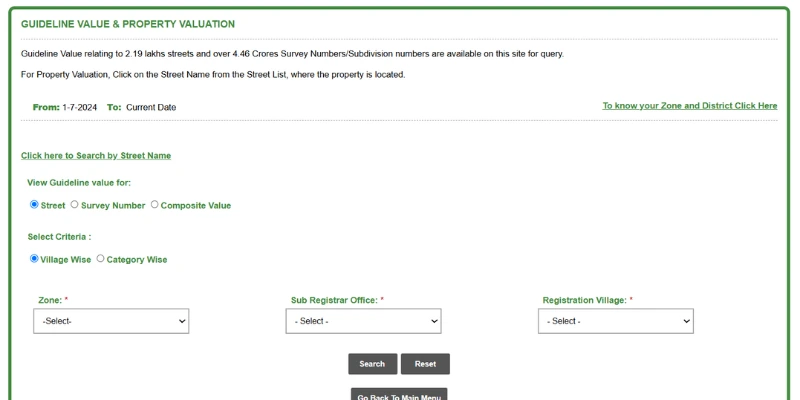

Step 3: Click on ‘From 01-07-2024’ to get the latest values.

Step 4: Choose either street name or survey number, then fill in details like your region, registration office, village name, and land type. After that, click on the ‘Search’ button.

Step 5: The guideline value for your property will be shown on the screen.

How to Check Jurisdiction For Guideline Value?

You can check Jurisdiction For Guideline Value by following these steps:

Step 1: Go to the official TNREGINET website.

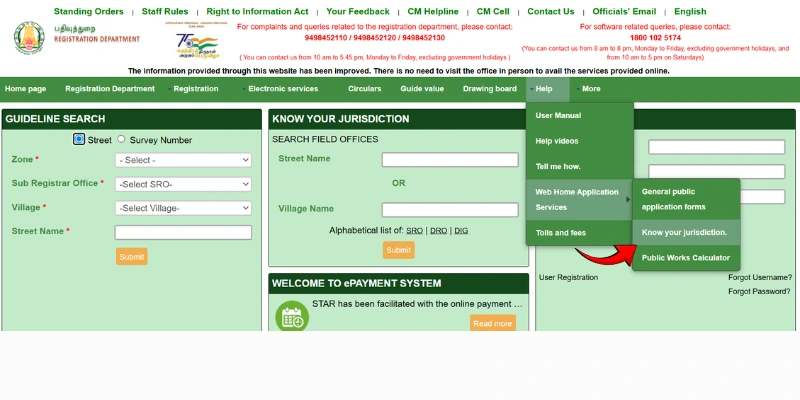

Step 2: On the homepage, click on the ‘Help’ tab, then choose ‘Web Home Application Services’.

Step 3: Click on ‘Know your jurisdiction’.

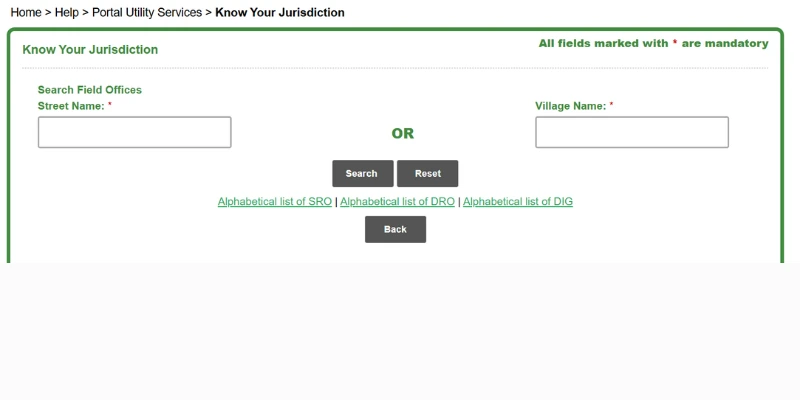

Step 4: In the search box, type your street name or village name, then click ‘Search’.

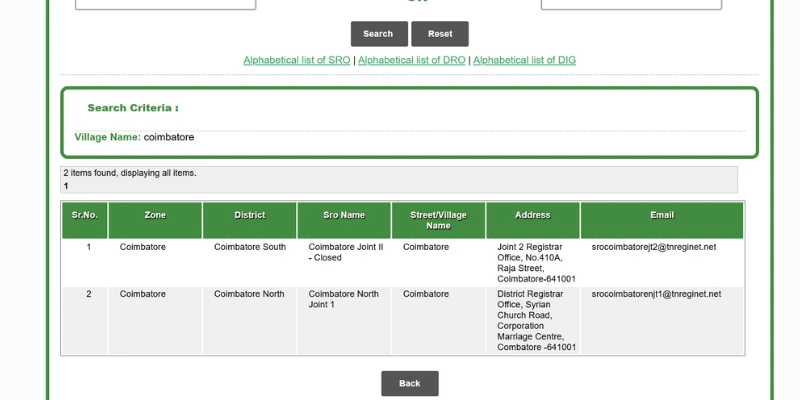

Step 5: You will see details like the name and address of the sub-registrar office and their email ID.

How to Calculate Building Value on TNREGINET?

You can find out the building value on the TNREGINET website by following these steps:

Step 1: Go to the official TNREGINET website.

Step 2: Scroll down the homepage and click on ‘Calculation of Building Value’.

Step 3: Choose your building type, then fill in the required details like region, age of the building, calculation period, and unit. After that, click on ‘Submit’.

Step 4: The estimated building value will appear on your screen.

Importance of TNREGINET Guideline Value

- Stamp Duty Calculation: Guideline value determines the stamp duty and registration fees applicable on a property transaction.

- Property Tax Estimation: Municipal bodies consider GV while calculating property tax.

- Legal Validity: It provides a fair reference price for buyer-seller negotiations, avoiding undervaluation or overvaluation.

- Dispute Resolution: Acts as a base reference in legal disputes involving property valuation.

Land Registration Fees in Tamil Nadu

| Type of Document / Transaction | Stamp Duty | Registration Fee |

| Sale Deed (Property Sale) | 7% of market value | 4% of market value |

| Gift Deed (non-family members) | 7% of market value | 4% of market value |

| Gift Deed (family members) | ₹100 | 1% of market value (max ₹10,000) |

| Settlement Deed (non-family) | 7% of market value | 4% of market value |

| Settlement Deed (family members) | ₹100 | 1% of market value (max ₹10,000) |

| Exchange Deed | 7% on market value of property with higher value | 4% on same |

| Partition Deed (family members) | 1% of market value | 1% of market value |

| Partition Deed (non-family) | 4% of market value | 1% of market value |

| Mortgage with possession | 4% of loan amount | 1% of loan amount (max ₹2 lakhs) |

| Mortgage without possession | 1% of loan amount | 1% of loan amount (max ₹10,000) |

| Lease Agreement (up to 30 years) | 1% of total rent + deposit | 1% of total rent + deposit |

| Power of Attorney (family) | ₹100 | ₹100 |

| Power of Attorney (others) | ₹100 | 1% of property value (max ₹10,000) |

The TNREGINET website makes it easier for people to avoid visiting the sub-registrar office for small property-related tasks. Now, property owners and buyers can check the guideline value from the comfort of their homes. It also helps them quickly figure out the correct registration value.

Difference Between Market Value and Guideline Value

- Market Value: The actual price a buyer is willing to pay based on demand and property features.

- Guideline Value: The government’s assessed value used for calculating registration fees and duties.

In most cases, market value > guideline value, but in some high-demand areas, they may converge or overlap.

Frequently Asked Questions (FAQs) – TNREGINET Guideline Value

Q1: What does Guideline Value mean in Tamil Nadu?

Ans: Guideline value is the minimum price set by the government for property registration. It helps in calculating stamp duty and prevents undervaluation of property deals.

Q2: What details do I need to check the Guideline Value?

Ans: You need your property’s village name, street name or survey number, and registration zone to check the guideline value on the TNREGINET portal.

Q3: Why is Guideline Value important for buyers and sellers?

It ensures fair property pricing, helps calculate registration charges, and prevents fraud by making under-valuation and black money transactions harder.

Q4: Can I register property for less than the Guideline Value?

No, you cannot. The property must be registered at or above the guideline value. Registering below this value is not legally allowed.

Q5: Where can I check the official Guideline Value in Tamil Nadu?

You can visit the official TNREGINET portal (https://tnreginet.gov.in) and search by street or survey number to find the guideline value.

Q6: Is the Guideline Value applicable to flats and buildings too?

Ans: Yes, guideline value applies to plots, flats, and buildings. The TNREGINET portal lets you calculate building value separately based on its type and location.